Since Bitcoin hit the crypto ecosystem in 2009, a wave of other cryptocurrencies has since become available for the investing public. As the value of Bitcoin has gained more than 4,000%, retirement savers are now looking towards the crypto market to invest so that they can enjoy their golden years.

While it may be risky to pull all your retirement savings into the crypto market alone, adding Bitcoin or any of the other cryptocurrencies into your retirement portfolio is a smart investing decision for any long-term retirement saver who hopes to enjoy financial freedom even in retirement.

In this post, we will take a look at the top 3 cryptocurrency retirement methods, so that you learn the various ways to put your retirement savings into work. But before we dive deeper, let’s quickly summarize some of the reasons to consider crypto as a good investment strategy.

Why Consider Crypto As a Good Investment Strategy?

Top on the list of the reasons to consider investing in cryptocurrency for the long-term is cryptocurrency volatility.

While the crypto market can be highly volatile, the volatility can be a good thing – meaning, it could earn you a huge amount of profits in a (relatively) short amount of time.

Let’s look at Bitcoin’s price chart.

To put this in perspective, let’s take a look at a few hypothetical investment scenarios:

(At the time of this writing, one Bitcoin [BTC] is worth 56,517.)

Scenario #1: On January 12, 2019 ==> You invested $50,000 in Bitcoin (The value on that date was $3620).

Today the value of that investment would be worth $750,000.

Scenario #2: On January 27, 2017 ==> You invested $20,000 in Bitcoin (The value on that date was $925).

Today the value of that investment would be worth $1,220,000.

Scenario #3: On November 20, 2015 ==> You invested $10,000 in Bitcoin (The value on that date was $327).

Today the value of that investment would be worth $1,728,000.

Even though, Bitcoin has been volatile, that’s not a bad thing. If you look at it from the right perspective, it’s actually good. Simply because, you’ll never find an investment that rapidly increases in value that isn’t somewhat volatile along the way.

I’m not qualified to give investment advice. I just happened to believe (for whatever that’s worth) that a person can minimize risk via ‘education’ + ‘long-term investment strategy’.

The point is, volatility is the major factor why the crypto market is exciting.

It’s easy to see that Bitcoin (and other coins) are generally trending upwards as the years go on.

Another thing to keep in mind is that many coins are a lot like stocks, where their price increases as the company increases.

When it comes to investing in cryptos, one secret advantage that you can have over 98% of the investing public (that will eventually invest in cryptos several years from now) is to simply shift your perspective when it comes to cryptos.

Instead of looking at them as “digital coins”, see them as “tech companies” that have a CEO, a marketing team, a software team and so on.

Why should you look at them that way?

Because that’s what many of them are.

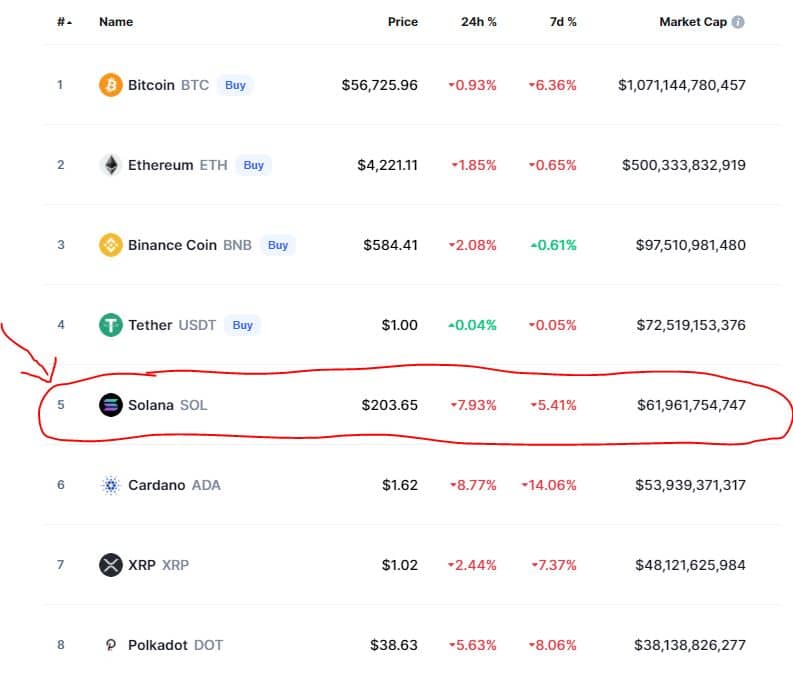

For example, go to coinmarketcap.com and take a look at the top cryptos.

If you go to Solana’s website (http://Solana.com), you’ll see that it’s actual company.

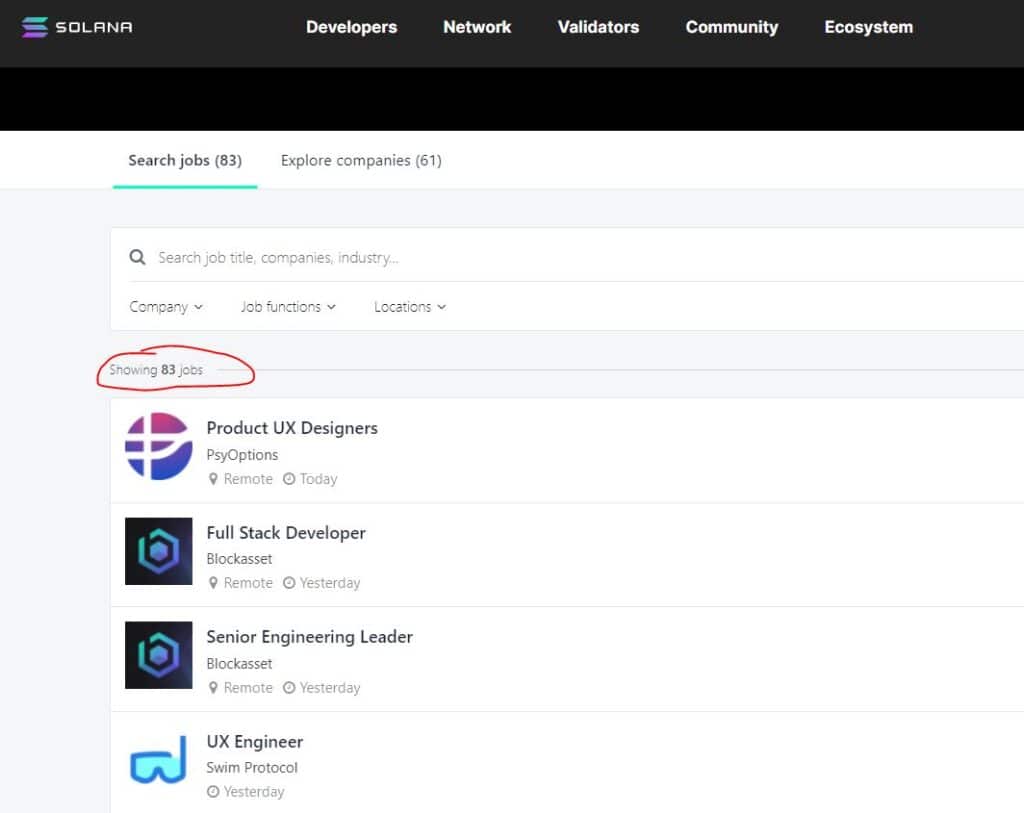

In fact, if you scroll down to the bottom and click ‘careers’, you’ll see that they are currently hiring for over 80 positions.

Another reason to consider cryptocurrency as a retirement strategy is that the market operates 24/7 with no government interference. Transactions involving cryptocurrencies can occur between two persons, as well as on an exchange. Plus, investors have the opportunity to either invest for the long-term or short-term basis. Now let’s take a look at the top 3 cryptocurrency retirement methods for retirement savers.

Crypto Retirement Method 1: Crypto IRAs

A Crypto IRA is one of the best crypto retirement methods available for those looking to enjoy financial freedom during their golden years.

Bitcoin IRAs are your best bet if you’re looking to avoid capital gains taxes while saving for retirement. For regular crypto transactions without an IRA, investors are usually subjected to capital gains taxes. But if you opt for any of the self-directed IRAs, you won’t pay these extra costs.

So many companies or organizations now offer this opportunity through self-directed IRAs. If you work in an organization that offers IRAs, you can direct the payroll unit to enroll you for the crypto IRA program. Some companies even provide storage options, custodian services, and 24/7 trading access.

Here are two to consider:

https://www.altoira.com

https://www.itrustcapital.com

(Note: I am not compensated in any way if you sign up with either of those two companies.)

Crypto Retirement Method 2: Buy And Hold Strategy

The buy and hold strategy is another lucrative crypto retirement method that you should include in your retirement plans. This strategy is for long-term retirement savers, that is, those that can buy a coin and hold it for as much as 5-20 years.

The buy and hold investing strategy comes with a lot of benefits, including tax savings and avoiding the stress that comes with market forecast and analysis. It is also very easy to implement and can also save you on transaction fees and commissions.

Crypto Retirement Method 3: Look At Companies With Related Technology

As we just mentioned, it’s best to think of crypos as tech companies. So lastly, investing in publicly traded companies that offer technology-related services or use blockchain to create different projects is another way to save for your retirement.

Examples of such companies include PayPal and Square. These two payment platforms now allow their users to trade cryptocurrencies.

Others are Galaxy Digital and Riot Blockchain, which focus on digital currencies and the underlying technology. Big names like Amazon, SAP, Google, IBM, and Microsoft are all making use of blockchain to develop different projects. Without holding cryptocurrencies directly, you can invest in these companies to enjoy a fruitful retirement.

Conclusion:

While there are many traditional ways to invest for retirement, it could be a good idea to add crypto investing to part of your retirement strategy. It’s sad, but there are a lot of people who go broke during retirement (read my post on 12 Reasons Why You Will Go Broke During Retirement). It’s possible that a small investment in cryptos right now — while using a long-term strategy — could easily be the one thing that makes life in your retirement years 10x better.